So, you want to buy a business but don’t have a pile of cash ready for a down payment. Good news: you don’t always need one.

Acquiring a business with no money down isn’t a myth; it’s a strategy. It’s done through creative deal structuring where you replace a traditional cash down payment with other forms of value. Think seller financing, earn-outs, or a leveraged buyout using the business’s own assets.

This approach is less about having empty pockets and more about mastering the art of the deal.

Let’s get straight to the point: buying a business with no money out of your own pocket is absolutely possible. In fact, savvy entrepreneurs pull it off every single day. The common misconception is that you’re getting something for nothing. The reality is you’re substituting a hefty cash payment with other financial tools that make the deal a win-win for both you and the seller.

Forget the idea that you need a personal fortune stashed away. Instead, picture this process as a financial puzzle. Your job is to assemble different funding pieces—none of which come from your personal savings—to cover the entire purchase price. It definitely demands more creativity, grit, and negotiation than a simple cash deal, but the reward is huge: ownership without the massive upfront barrier.

This journey starts with a simple but powerful mindset shift: stop thinking, “I don’t have the money,” and start asking, “How can I structure this deal without my own cash?” This one change opens up a world of possibilities. You’re not asking for a handout; you’re crafting a well-reasoned, mutually beneficial proposal.

Success in a zero-down acquisition boils down to a few core ingredients:

The real secret to a no-money-down deal is convincing the seller to invest in you as their successor. You’re not just buying their assets; you’re showing them you’re the best person to carry their company forward, making them a partner in your future success.

Typically, buying a small business requires a down payment of 10% to 25%. But that’s just a starting point, and smart negotiation can change everything.

Consider this: with the median small business sale price sitting around $352,000, skilled buyers are often closing deals at about 93% of the original asking price. That negotiation alone immediately shrinks the amount of capital you need to bring to the table. You can dive deeper into these small business sale price insights to see how powerful good negotiation can be.

Of course, you still need a rock-solid business plan and enough working capital to keep the lights on after you take over. For a closer look at that, check out our guide on establishing sufficient capital reserves.

Now, let’s get into the specific strategies you’ll use to find the right business and structure the perfect deal.

To give you a quick overview, here are the core financing methods we’ll be breaking down. Each one offers a unique way to fund an acquisition without dipping into your personal savings.

| Strategy | How It Works | Key Advantage |

|---|---|---|

| Seller Financing | The business owner acts as the bank, accepting payments over time instead of a lump sum. | The seller is invested in your success and terms can be highly flexible. |

| SBA Loans | Government-backed loans where a seller’s note can often satisfy the equity/down payment requirement. | You get favorable terms and a high loan-to-value ratio, often up to 90%. |

| Earn-Outs | A portion of the purchase price is paid later, based on the business’s future performance. | Reduces your upfront risk by tying the final price to actual results. |

| Leveraged Buyout (LBO) | You use the business’s own assets and cash flow as collateral to secure a loan for the purchase. | The business essentially pays for itself over time. |

These strategies are the building blocks of a no-money-down deal. Often, the most successful acquisitions will combine two or more of these methods to create a structure that works for everyone involved.

Let’s be clear: not every business for sale is a candidate for a zero-down purchase. The truth is, only a tiny fraction of them fit the unique criteria needed to make this kind of deal work. Your job is to stop wasting time sifting through thousands of listings and start hunting strategically for the handful of businesses that are perfectly positioned for a creative acquisition.

This requires a complete shift in how you look at opportunities. You aren’t just looking for a profitable company. You’re searching for a specific situation—a unique blend of owner motivation, solid financials, and operational quirks that create the perfect opening for a no-money-down offer.

The single most important factor, hands down, is the seller’s mindset. If an owner needs every last dollar in cash at the closing table, they are not your target. Move on.

Instead, you’re looking for someone whose priorities go beyond a quick payday. These are often owners who care deeply about their company’s legacy, the future of their employees, and finding the right person to take over.

You can often spot these sellers by looking for a few tell-tale signs:

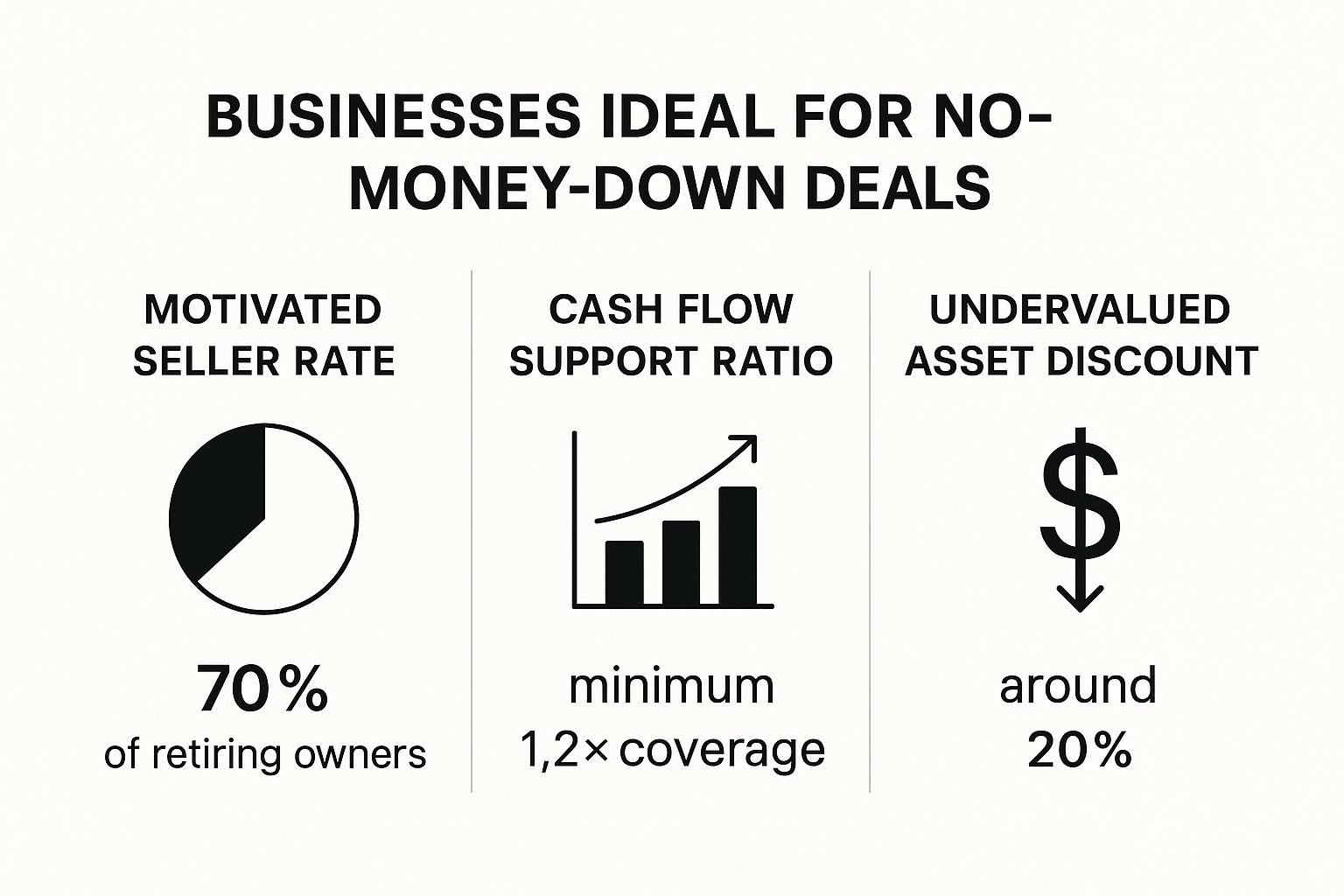

This isn’t just theory; a massive demographic shift is making these sellers more and more common. A huge wave of U.S. small business owners is heading for the exit, with up to 30% admitting they’ve sped up their transition plans. And here’s the kicker: around 70% of these owners have no formal succession plan. This creates a prime environment for buyers like you to negotiate favorable, creative terms. For more on this, you can explore the latest small business acquisition data.

Once you find a motivated seller, the business’s financials have to be strong enough to support the deal. Remember, in a no-money-down deal, the business itself has to generate enough cash to pay off the loan you used to buy it.

The golden rule is that the company’s Seller’s Discretionary Earnings (SDE) must comfortably cover the future debt payments. A lender—and any smart buyer—will look for a Debt Service Coverage Ratio (DSCR) of at least 1.25x. This simply means the business generates $1.25 in cash for every $1.00 of debt it needs to repay.

If that ratio dips below 1.25x, the deal is too risky. It’s a huge red flag that the business can’t sustain itself after you take over. Strong, consistent, and predictable cash flow is absolutely non-negotiable.

Some businesses are sitting on hidden value that can be used to secure financing. These are assets that aren’t being fully used or aren’t accurately reflected on the balance sheet. Finding them is like finding a key to unlock your deal.

For instance, a manufacturing company might own its building free and clear. You could structure a sale-leaseback transaction to pull cash out for the acquisition. Or maybe a service business has a huge accounts receivable balance that could be factored or used as collateral for an asset-based loan.

Look for these hidden gems during your initial analysis:

These elements can become the crucial pieces of your financing puzzle. For more practical advice on spotting these opportunities, review these essential tips and guides for business buyers.

Finding the right business isn’t a game of luck. It’s a strategic process of identifying the right circumstances and knowing exactly what to look for.

Seller financing is the secret sauce behind most no-money-down deals. Think of it this way: instead of you going to a bank for a loan, the seller becomes the bank. They agree to accept payments over time rather than getting a massive check at closing. If you want to buy a business without draining your own bank account, you absolutely have to master this strategy.

The trick is to frame it as a mutual victory, not a favor to you. You’re offering the seller a reliable income stream, usually with a nice interest rate. More importantly, you’re giving them peace of mind that their legacy is in good hands. It’s a partnership, not just a transaction.

Your first chat about seller financing can make or break the deal. Don’t come at it like you’re asking for a handout. You need to present it as a smart, strategic solution that benefits both of you. Build a case that you’re a safe bet and their investment in you is secure.

Start by tapping into the seller’s priorities. Have they mentioned how much they care about their employees or the brand’s reputation? Perfect. Connect your proposal directly to those concerns. Explain how taking over without being buried in bank debt allows you to protect everything they’ve built.

Try using conversation starters like these:

This infographic breaks down what makes a business a prime candidate for this kind of creative financing.

As you can see, the perfect storm for a no-money-down deal is a highly motivated seller combined with a business that has strong cash flow and undervalued assets.

The seller note (or promissory note) is the formal legal document laying out the loan terms. Getting this right is everything. It needs to be clear, fair, and protect both of you, because a badly written note is a recipe for disaster later.

Your main goal is to negotiate terms the business’s cash flow can comfortably handle. This isn’t just a fringe idea; M&A advisory firms report that around 80% of small business sales involve some seller financing. It’s a standard tool. To dig deeper into how common this is, you can explore more insights on seller financing deals.

The best seller notes are structured with the business’s worst-case scenario in mind. If the company hits a slow quarter, can it still make the payment easily? If the answer is no, your terms are too aggressive.

When you get down to the details, these are the core parts of the seller note. Each one is a lever you can pull to make the deal work for everyone.

1. Interest Rate

The interest rate on a seller note is usually a bit higher than a bank loan, often landing between 6% to 10%. This is fair—the seller is taking on more risk. But it’s completely negotiable. You might trade a lower interest rate for a shorter payback period or a slightly higher overall price.

2. Repayment Term

This is how long you have to pay back the loan, typically 5 to 10 years. A longer term means smaller monthly payments, which is great for your cash flow. Propose a term that makes sense based on the company’s past performance and gives you plenty of breathing room.

3. Payment Schedule

Most notes use simple monthly payments, but you can get creative here. Is it a seasonal business? Propose bigger payments during the high season and smaller, “interest-only” payments when things are slow. This is a huge advantage over inflexible bank loans.

4. Subordination

This is a critical point, especially if you’re bringing in an SBA loan for part of the deal. A subordination agreement means the seller agrees their debt gets paid back after the bank’s debt if things go south. Most banks and the SBA will require the seller’s note to be on standby (meaning no payments for 24 months) or fully subordinated. Bring this up early.

By negotiating these points thoughtfully, you create a deal that feels less like debt and more like a true partnership. You’re not just buying a business; you’re gaining a financial partner who’s rooting for your success.

When you’re piecing together a zero-down deal, you’ll likely blend a few different financing methods. Each has its own strengths and weaknesses. Understanding the landscape helps you choose the right tools for your specific acquisition.

The table below breaks down the most common options to give you a clearer picture of how they stack up.

| Financing Method | Typical Use Case | Pros | Cons |

|---|---|---|---|

| Seller Financing | The cornerstone of most no-down deals, covering a large portion of the sale price. | Flexible terms, motivated seller, faster closing. | Higher interest rates, seller may want some control. |

| SBA 7(a) Loan | Used to finance the bulk of the purchase when a seller won’t finance 100%. | Long repayment terms (10 years), government-backed, competitive rates. | Strict requirements, requires a down payment (can be from seller note), lengthy approval process. |

| Earn-Out | For businesses with uncertain future performance or when buyer and seller disagree on value. | Payments are tied to future success, reducing upfront risk. | Can lead to disputes over performance metrics, complicates accounting. |

| Assuming Debt | Taking over the existing business debts (loans, lines of credit) as part of the price. | Reduces the cash needed at closing, can be a simple transfer. | You inherit all terms, potential for hidden liabilities, requires lender approval. |

Choosing the right mix depends entirely on the business you’re buying, the seller’s motivations, and your own financial standing. Often, the best deals combine a primary method like seller financing with a smaller component, like an earn-out, to bridge any valuation gaps and align everyone’s interests.

While a big seller note is the engine of most zero-down deals, it usually only gets you part of the way there. The real art of the deal is layering other funding sources on top of seller financing to close the gap. This is where you can get creative with government-backed loans and other smart strategies to build a 100% financed acquisition.

A lot of aspiring buyers hit a wall when they hear about the Small Business Administration (SBA) and its infamous equity injection requirement—typically 10-25% of the total deal cost. They assume it’s a non-starter for a no-money-down deal. But there’s a powerful loophole that savvy buyers use every single day.

Here’s the secret sauce: the SBA will often let a seller’s note count toward your required equity injection. But there’s a catch. The note has to be on full standby, meaning you make no payments on it—principal or interest—for the first 24 months of the SBA loan.

From the SBA’s point of view, this is a great arrangement. It ensures the business’s cash flow is focused entirely on paying back the bank first, which lowers their risk. It also shows that the seller is confident you can run the business successfully.

For you, it’s a total game-changer. The seller’s loan effectively becomes your “cash” down payment, letting you secure a major bank loan without putting a dollar of your own money into the deal.

Let’s say you’re buying a business for $1,000,000. The bank needs a $100,000 (10%) equity injection to approve a $900,000 SBA loan. Instead of scrambling for that cash, you negotiate for the seller to carry a $100,000 note on full standby for two years. The bank agrees, and just like that, you’ve met the requirement without touching your personal savings.

The SBA 7(a) loan is the go-to tool for business acquisitions. Buyers love them because they offer long repayment terms and competitive interest rates, which makes the debt much more manageable for a newly acquired company.

SBA loans can finance up to 75% of deals between $150,000 and $5 million, with rates usually around 8-10% and repayment terms stretching out 7 to 10 years. They’re a fantastic tool for buyers who don’t have a ton of cash on hand. In fact, as of 2025, about 62% of buyers report using seller financing alongside other funding to get their deals done.

A successful SBA-backed deal is less about your personal bank account and more about the business’s track record. Lenders are underwriting the deal based on one thing: can the business generate enough cash to cover the new loan payments?

Beyond the SBA, there’s a whole toolkit of alternative funding strategies that can help you bridge that final gap. Think of them as specialized tools you can pull out depending on the specific deal and the assets of the business you’re targeting.

Here are a few options worth exploring:

Layering these strategies takes some planning and sharp negotiation. For a deeper dive into how all these pieces fit together, check out our guide on how to finance your business purchase using loans, SBA, and seller financing. By combining a seller note, an SBA loan, and maybe one of these alternative methods, you can build a deal that requires absolutely no cash out of your own pocket.

Structuring the perfect no-money-down deal is one thing, but that fancy structure is worthless if the business can’t actually support the payments. This is where sharp negotiation and relentless due diligence become your two most important tools.

Your goal here is to move beyond a simple transaction. You need to build a genuine partnership with the seller while verifying every single number and assumption with a healthy dose of skepticism.

Great negotiation in a zero-down deal isn’t about winning a fight; it’s about building a bridge. You’re asking the seller to bet on you by financing your purchase, and that requires a massive amount of trust. You build it by showing genuine respect for what they’ve built, listening to their real concerns, and framing your proposals around a future where you both win. The conversation has to shift from “Here’s my offer” to “How can we make this work for everyone?”

Here’s something most buyers miss: many sellers are more concerned with their legacy than with squeezing every last dollar out of the sale.

In fact, a surprising 43% of business sellers prioritize the continuity of their company and the well-being of their employees over the final price tag. This makes them far more open to creative deals, like seller financing, that ensure a smooth handover. With over 3.2 million small businesses currently on the market, you’ll find plenty of these opportunities. You can dig deeper into the numbers by checking out these small business acquisition trends.

That statistic is your key. You need to frame your offer around these non-financial motivations:

When you align your goals with theirs, you stop being just another buyer. You become the successor they were hoping to find.

When the business has to start servicing new debt from day one, your due diligence has to be laser-focused. You’re not just confirming the numbers are real; you’re stress-testing the company’s ability to perform under pressure.

Forget a generic checklist. You need one designed specifically for a leveraged buyout.

Due diligence in a no-money-down deal has one mission: prove beyond a shadow of a doubt that the business’s historical cash flow can comfortably cover its future debt, even if things go south for a bit.

Your investigation needs to be ruthless on three key fronts:

The whole point of due diligence isn’t to kill the deal—it’s to refine it. Every risk you uncover is a chance to adjust the terms in your favor.

The key is how you present it. Approach the seller with respect, framing your findings as shared problems that need a collaborative solution.

This approach does more than just improve your terms. It shows you’re a serious, detail-oriented operator, which only builds the seller’s confidence that you’re the right person for the job.

Even with a killer strategy, the thought of buying a business with zero cash out of pocket is bound to bring up some questions. That’s completely normal. Let’s tackle the big ones head-on so you can move forward with confidence.

These are the real-world concerns that pop up right before you’re about to make an offer.

While a flawless credit score is a huge plus—especially if an SBA loan is in the mix—it’s not always a deal-breaker. Lenders see a strong credit history as proof of your financial discipline. A higher score simply means you look like less of a risk. Simple as that.

But in a deal with 100% seller financing, the game changes completely. The seller is betting on you, not your FICO score. Your industry experience, a rock-solid business plan, and the trust you’ve built with them often carry far more weight. I’ve seen buyers with less-than-perfect credit close deals because their plan was just that convincing.

Hands down, the single biggest risk is overleveraging the business. When you don’t put any of your own money in, the company starts day one with a heavy debt load. A huge chunk of its monthly cash flow is immediately earmarked for loan payments.

This leaves you with an incredibly thin margin for error. What happens if you hit a slow month? Lose a key customer? Face an unexpected repair bill? You could find yourself unable to make payments, defaulting on the loan, and potentially losing the business you just fought so hard to acquire.

The only way to hedge against this is through obsessive due diligence. You have to stress-test the company’s financials. Make sure it can comfortably handle the new debt, even if sales dip.

Finding a seller willing to finance the entire deal is the unicorn of business acquisitions. It’s rare, but it does happen. It usually requires a perfect storm of circumstances.

You’re looking for a seller who is:

For a seller to even consider this, they need absolute, unwavering confidence that you can run the business successfully and pay them back over time.

What’s far more common is achieving a “no money down” deal by combining a large seller note with another type of financing. For instance, getting a seller to carry 70-90% of the price can satisfy the equity injection requirement for an SBA loan. This is a proven, effective strategy for buying a business without touching your personal savings.

Pulling off a no-money-down deal takes more than just a good idea—it requires expertise and access to the right sellers. The team at Vic & Wayne Brokers has spent decades guiding buyers through every step, from finding the perfect business to structuring creative financing. Discover how we can help you get a deal done by visiting us at https://bestbusinessbrokerteam.com/contact.