Most business owners know their sales numbers, profits, and expenses but surprisingly few know what their business is actually worth.

Understanding your business’s value isn’t just important when you’re ready to sell. It’s a powerful tool that can help you make smarter decisions, plan for growth, and prepare for the future.

In this guide, we’ll explore why every business owner should consider a valuation, when to get one, and how it can directly impact your company’s success.

A business valuation is a professional assessment that determines the fair market value of your company. Essentially, what your business would likely sell for in today’s market.

Valuations can be conducted in several ways, including:

Knowing your business’s worth gives you a clear picture of where you stand and what areas can be improved to increase value.

Many business owners assume valuations only matter when it’s time to sell. In reality, understanding your company’s worth can influence nearly every strategic decision you make.

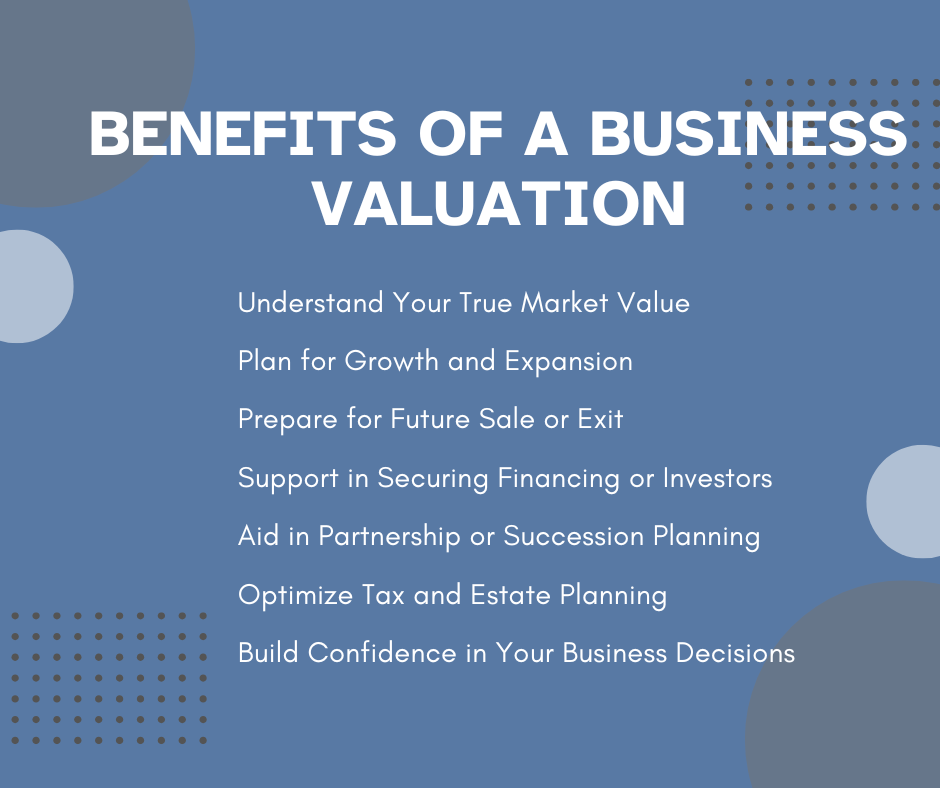

Getting a valuation is about more than numbers, it’s about clarity, control, and confidence. It helps you:

Whether you plan to sell in a few years or simply want to manage your business smarter, knowing your value is essential.

Many owners overestimate or underestimate their business’s value. A professional valuation gives you an objective, data-driven answer, helping you make informed decisions about growth or sale.

A valuation reveals what drives your company’s worth. You’ll see which areas contribute most to value and which need improvement. This insight helps you plan expansions, invest wisely, and measure progress year over year.

Even if you’re not selling today, one day you might. Getting a valuation now allows you to plan ahead, improve weaknesses, and position your business for a higher sale price when the time comes.

Banks, lenders, and investors often require an updated business valuation before approving funding. Having one on hand speeds up the process and builds confidence with financial partners.

If you’re adding a partner, dividing equity, or planning for family succession, a valuation ensures everyone understands the fair market value and avoids disputes.

A valuation helps business owners make informed decisions about taxes, gifting shares, and long-term wealth management. It’s essential for estate planning and protecting your legacy.

When you know what your business is worth, you make decisions with clarity from negotiations to investments to exit planning.

You don’t need to wait until you’re selling your business to get a valuation. Smart business owners treat it as part of regular planning.

You should consider a valuation when:

For many Las Vegas business owners, a valuation every few years provides valuable insight for long-term strategy.

Every valuation is unique, but most are influenced by a combination of the following factors:

Improving these areas can significantly increase your company’s value, whether you plan to sell soon or simply want to grow smarter.

At Vic & Wayne, we don’t just connect buyers and sellers. We help business owners understand and enhance what makes their company valuable.

Our team provides:

Curious about what your business is worth? Contact Vic & Wayne today for a confidential consultation and personalized valuation guidance.

How often should I get a business valuation?

Most experts recommend every 2–3 years, or whenever your business experiences major growth or change.

How long does a business valuation take?

Depending on complexity, it can take anywhere from a few days to a few weeks.

Do I need a valuation if I’m not selling my business?

Yes, valuations are valuable for planning, financing, and measuring performance, not just selling.

What information is needed for a valuation?

Typically, financial statements, tax returns, and details about assets, operations, and customer base.

How much does a business valuation cost in Las Vegas?

Costs vary by size and complexity, but Vic & Wayne can connect you with trusted, affordable valuation professionals.

A business valuation is a roadmap to understanding, growing, and protecting the value you’ve built.

Knowing your worth empowers you to make smarter decisions, attract the right buyers, and plan confidently for the future.

We’re here to help Las Vegas business owners discover their true value and turn that knowledge into long-term success.

Ready to find out what your business is worth? Contact Vic & Wayne today to schedule your professional valuation consultation.